Struggling with Healthcare Investments? How 5starsstocks.com Healthcare

Hey there, fellow investor! Imagine this: You’re scrolling through news about breakthrough drugs or fancy new medical gadgets, thinking, “This could be huge for my portfolio.” But then doubt creeps in— which companies are actually worth your hard-earned cash? The healthcare world is buzzing with innovation, from AI diagnostics to gene editing, but it’s also full of risks like failed trials or regulatory hurdles. That’s exactly the pain point 5starsstocks.com healthcare tackles head-on. This platform acts like your personal navigator, cutting through the noise to spotlight solid opportunities in medical investments.

I’ve been down this road myself. A few years back, I dipped my toes into biotech stocks without much guidance and watched one pick tank after a bad FDA update. Lesson learned: You need reliable tools. That’s why I’m excited to dive into 5starsstocks.com healthcare today. It’s a specialized corner of the broader 5starsstocks.com site, designed to help everyday folks like us make smarter choices in this trillion-dollar industry. Let’s break it down step by step, so you can see if it’s the right fit for your investment journey.

What Is 5starsstocks.com Healthcare and Why Should You Care?

Picture 5starsstocks.com healthcare as a smart compass for the messy map of medical stocks. It’s not just a list of tickers—it’s a full-on analysis hub that blends data crunching with real-world context. Born from the main 5starsstocks.com platform, which covers everything from tech to defense, this healthcare arm zeros in on the sector’s unique twists.

At its core, it’s about making complex info digestible. Whether you’re a newbie saving for retirement or a seasoned trader hunting growth, it offers ratings, projections, and strategies tailored to health-related investments. Think of it as combining the depth of professional research with the ease of a user-friendly app. And with the healthcare market projected to hit $8.3 trillion by 2028, getting in now could pay off big— but only if you pick wisely.

What sets it apart? It doesn’t treat all healthcare stocks the same. Instead, it slices the sector into bite-sized pieces, helping you avoid overwhelm. Plus, it’s updated regularly to reflect fresh market shifts, like recent booms in weight-loss drugs or telemedicine.

Key Features That Make 5starsstocks.com Healthcare a Game-Changer

Let’s get into the nuts and bolts. This isn’t your grandma’s stock picker—it’s powered by clever tech that thinks like a pro analyst. Here’s what stands out:

The 5-Star Rating System: Simple Yet Powerful

Ever wondered how to rate a stock beyond just its price? 5starsstocks.com healthcare uses a hybrid AI model for its signature 5-star ratings. It pulls in real-time data like earnings reports, FDA approvals, patent filings, and even news sentiment. The cool part? It weighs factors differently based on the company type. For a tiny biotech, a fast-track drug approval might bump it to 5 stars, while a big pharma giant needs consistent revenue growth to shine.

This system helps you spot winners quickly. For example, a stock like Intuitive Surgical (ISRG) might score high for its robotic surgery innovations, showing steady climbs in revenue. It’s like having an expert filter out the duds.

Interactive Tools for Smarter Decisions

No more guessing games. The platform packs tools that feel like insider secrets:

- Biotech Heat Map: Scan companies by drug development stages—preclinical, Phase I, or FDA-approved. Filter by disease (like cancer or diabetes) or market size. Perfect for timing your buys, as getting in early on Phase II successes can lead to big gains.

- Risk Radar: A color-coded alert system (red for high risk, green for go) flags issues like legal troubles or regulatory delays. It’s saved me from jumping into shaky picks in the past.

- Genomics Tracker: Tracks leaders in CRISPR, gene therapy, and mRNA tech. It includes patent updates and insider buying trends, highlighting firms like those behind COVID vaccines that pivoted to new frontiers.

- Legacy Vs. Upstart Matrix: A visual quadrant comparing stable giants (think Johnson & Johnson) to nimble startups. Helps balance your portfolio between safe bets and high-growth rockets.

These features make investing feel less like gambling and more like strategy. And they’re user-friendly— no finance degree required.

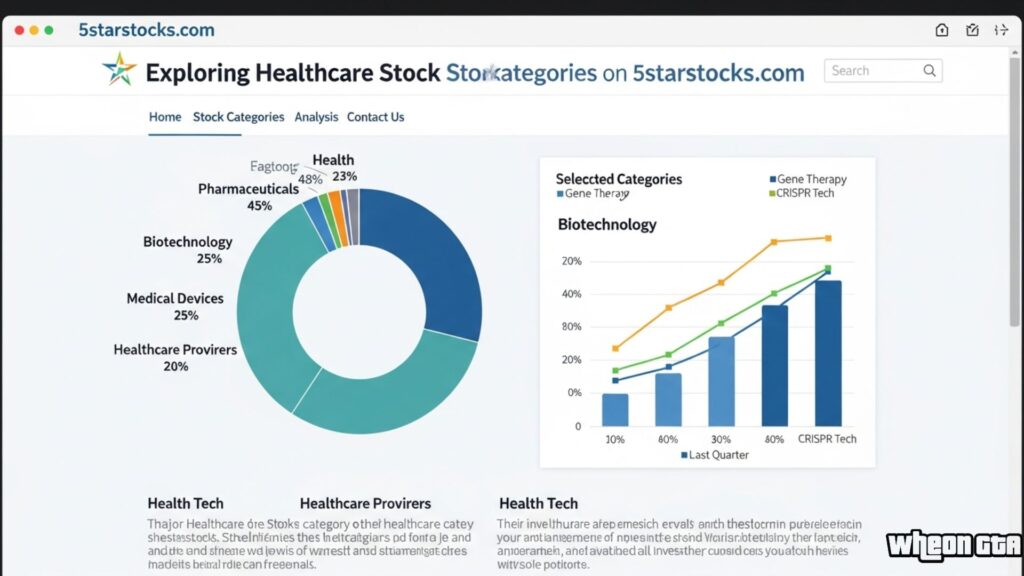

Exploring Healthcare Stock Categories on 5starsstocks.com

Diversity is key in investing, right? 5starsstocks.com healthcare breaks down the sector so you can mix and match. Here’s a rundown of the main subsectors, with why they matter:

Biotech & Pharma: The Growth Engines

This is where the excitement lives. Companies developing new drugs or therapies often see explosive growth. The platform highlights firms with strong pipelines, like those in GLP-1 drugs for weight loss (e.g., Ozempic makers). Look for consistent revenue jumps and innovative products. Pain point solved: It helps you avoid flops by focusing on historical success rates in clinical trials.

Medical Devices and Tech: Innovation Meets Practicality

From wearables like Apple Watches turning clinical to robotic surgery tools, this area blends tech with health. 5starsstocks.com spotlights leaders with strengthening market positions. For instance, medtech firms benefit from aging populations needing more devices— a global trend driving steady demand.

Insurance, Hospitals, and Genomics: The Stable Players

For lower volatility, check insurance payers or hospital chains post-COVID consolidations. Genomics stands out for future-proofing, with companies in personalized medicine. The site encourages diversification here to weather economic dips.

In a nutshell, these categories cater to different styles—growth seekers love biotech, while income hunters prefer stable hospitals. Semantic variations like “healthcare tech investments” or “biotech stock picks” fit naturally as you explore.

| Category | Main Qualities | Best For |

|---|---|---|

| Biotech & Pharma | Rapid innovation, drug pipelines | High-growth chasers |

| Medical Devices | Tech integration, steady demand | Balanced risk-takers |

| Healthcare Tech | Telemedicine, wearables | Future-focused investors |

| Insurance & Payers | Stable revenues, mergers | Income stability seekers |

| Genomics | Gene editing, patents | Long-term visionaries |

This table shows how to align with your goals. Remember, always diversify to spread risk.

How to Use 5starsstocks.com Healthcare Effectively

Getting started is straightforward. First, clarify your goals: Are you after quick wins or long-haul stability? Then, pick categories that match. Dive into details like performance data and risk assessments for each stock.

A real-life tip from my experience: Start small. I once built a mini-portfolio mixing a biotech upstart with a blue-chip like Johnson & Johnson for balance. Use the buy-now suggestions for timely picks, but cross-check with your risk tolerance. The platform’s updates reflect market cycles, like interest rates impacting valuations.

Pro tip: Combine with economic factors. High inflation might favor defensive healthcare stocks, as people always need meds regardless of the economy.

Benefits and Comparisons: Is It Worth It?

Why bother with 5starsstocks.com healthcare? It saves time— no more endless research. It boosts confidence with data-backed insights, opening doors to diverse opportunities. Compared to giants like Morningstar or Zacks, it shines in AI-driven granularity and healthcare-specific tools. Morningstar offers broad ratings but lacks the real-time FDA tracking here. Zacks has strong analysis, but 5starsstocks.com’s dashboards feel more intuitive for beginners.

Users range from retail investors to pros. Even hedge funds reportedly tap its API. But disclaimer: No tool guarantees profits. Markets are unpredictable, so do your own due diligence and consider consulting a financial advisor. Past performance isn’t future-proof.

On the flip side, the freemium model means premium features cost extra. And as a newer player, it lacks decades of backtesting. Still, in a digitizing investment world, it’s democratizing access to smart picks.

Risks and Smart Habits for Healthcare Investing

Healthcare investing thrills with potential, but watch for pitfalls. Volatile biotechs can crash on trial failures— the Risk Radar helps spot these. Regulatory changes, like FDA shifts, affect valuations too.

Build good habits: Start with small amounts, invest consistently to average out fluctuations, and stay updated on news. Diversify across subsectors, and review your portfolio quarterly. This approach has helped me turn initial setbacks into steady growth.

Wrapping Up: Your Next Step in Healthcare Investments

We’ve covered a lot— from the clever features of 5starsstocks.com healthcare to practical categories and tools that make investing less daunting. It’s clear this platform addresses real pain points, like sifting through hype to find genuine opportunities in biotech, pharma, and beyond. By blending AI smarts with user-friendly design, it empowers you to build a portfolio that aligns with your life goals, whether that’s funding retirement or riding the wave of medical breakthroughs.

So, if you’re ready to level up your investments, head over to 5starsstocks.com and explore the healthcare section. Remember, investing is a marathon, not a sprint— start informed, stay patient, and watch your wealth grow. Who knows? Your next big win might be just a 5-star rating away. Happy investing!

FAQ Section

Q: What is 5starsstocks.com healthcare and how does it help beginners?

A: 5starsstocks.com healthcare is a dedicated platform section offering stock recommendations in biotech, pharma, and medtech. It simplifies choices with AI ratings and tools like risk alerts, helping beginners avoid common pitfalls and build diversified portfolios confidently in under 70 words.

Q: How do I find top picks on 5starsstocks.com healthcare for growth?

A: On 5starsstocks.com healthcare, use the Biotech Heat Map to filter high-growth stocks by drug stages and market potential. Focus on companies with strong pipelines like gene therapy leaders, ensuring alignment with your risk level for potential high returns.

Q: Is 5starsstocks.com healthcare reliable for long-term investments?

A: Yes, 5starsstocks.com healthcare provides data-driven insights on stable sectors like hospitals and insurance, with regular updates on economic factors. It’s great for long-term strategies, but always verify with personal research to match your financial goals.

Q: What tools does 5starsstocks.com healthcare offer for risk management?

A: 5starsstocks.com healthcare features the Risk Radar for spotting regulatory or clinical risks, plus a matrix comparing legacy firms to startups. These help manage volatility in healthcare stocks, promoting balanced, informed decisions for safer investing.

Q: Can 5starsstocks.com healthcare guide investments in emerging tech like genomics?

A: Absolutely, 5starsstocks.com healthcare’s Genomics Tracker monitors CRISPR and mRNA companies with patent and partnership updates. It’s ideal for tapping into future trends, offering insights to diversify and capitalize on innovative healthcare advancements effectively.